Online shopping is gaining popularity across the European continent.

The figures indicate that ecommerce revenue is expected to grow by 9.3% by 2027, rising from $631,869 billion in 2023 to $902,264 billion by 2027.

Moreover, the ecommerce sales in Europe’s top five economies are projected to grow steadily at a 7.8% Compound Annual Growth Rate (CAGR) until 2029.

More importantly, online sales are expected to account for 21% of all retail sales in those five countries by the end of the decade.

Combined with global ecommerce industry trends, which indicate that cross-border sales are projected to grow twice as fast as the ecommerce market by 2030, these figures suggest that Europe could be one of the best destinations for sellers to expand on online marketplaces.

Let’s dive deeper into the European ecommerce industry’s trends and statistics and discover expansion opportunities for your online store.

Key takeaways

- The ecommerce sales in China, the United States, and Western Europe will total $5.17, or more than 80% of global ecommerce sales in 2025.

- The number of ecommerce users in the UK is expected to rise to 53.6 million by the end of 2026.

- Cross-border ecommerce revenue in Europe is projected to increase by $55.47 billion between 2022 and 2026.

- 84% of online shoppers in the EU buy products on domestic online marketplaces.

- The most active online shoppers in the EU are between the ages of 25 and 44.

The current state of online retail in Europe

The introduction of the new product safety regulations at the end of 2024 has raised concerns among international sellers about the future of ecommerce in the EU.

Additionally, in July 2025, the European Commission announced its plans to remove the customs exemption for items valued at or below €150 by 2028.

Despite these efforts to increase consumer safety and restrict the availability of potentially harmful products to European consumers, the continent’s ecommerce industry is expected to continue to thrive.

User penetration is projected to increase from 50.3% in 2024 to 58.9% in 2029, with an average revenue per user of $1,890 during that period.

The Netherlands, the UK, Sweden, and Denmark are among the countries with the highest online shopping participation.

Conversely, countries like Italy and Portugal had considerably lower user penetration but are expected to be among the fastest-growing ecommerce marketplaces in 2026 in Southern Europe.

Digital marketplaces like Amazon, eBay, Bol, or Zalando are highly saturated, making it difficult for international sellers to establish a presence.

A glance at online shopping trends in Europe

A recently published study reveals that the European region’s largest ecommerce markets are not growing as fast as smaller markets.

Consequently, Bulgaria, Greece, Poland, and Ireland are projected to be among the top ten European countries by CARG between 2024 and 2028.

Nonetheless, the UK, Germany, France, Spain, and Italy will continue to grow steadily by the end of the decade and remain the continent’s largest ecommerce marketplaces.

Approximately 32% of shoppers from the top five European economies are already frequently purchasing products from sellers in other European countries, suggesting a growth of cross-border trade in the region.

The cross-border shopping trend is likely to continue gaining traction as an increasing number of consumers make their purchasing decisions primarily based on the item’s price and perceived value.

Moreover, the decline in offline retail across the continent suggests the rise in popularity of shopping through digital channels.

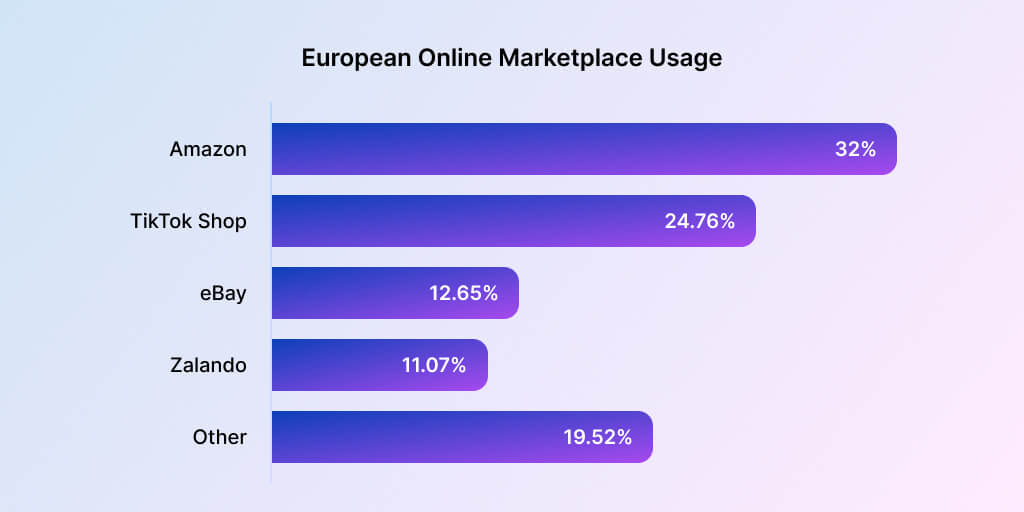

Although Amazon will remain the most dominant online marketplace in Europe for the foreseeable future, 68% of online consumers purchase products from other marketplaces.

Hence, 24.76% of shoppers buy items from TikTok Shop, 12,65% use eBay as their go-to online shopping platform, and 11.07% of consumers in Europe buy products online through Zalando.

It’s also worth noting that regional online marketplaces, such as Bol, Allegro, or Cdiscount, attract a significant number of consumers across different European countries.

Keeping up with the regulatory requirements

The complex network of European Union regulations affecting sellers on online marketplaces is often the reason merchants hesitate to expand their businesses to European countries.

The Digital Services Act, GPSR, Consumer Rights Directive, or Extended Producer Responsibility are only a few among numerous regulations sellers from EU member states and third countries must comply with to make their products available to European consumers.

Additionally, the European Commission has announced several upcoming regulatory requirements, such as Digital Product Passports, that will have a profound impact on the EU’s e-commerce sector.

The EU’s and the UK’s constantly evolving regulatory framework can make it difficult for international sellers to gain a foothold on the European marketplaces.

Although highly regulated European markets incur additional costs for sellers, such as appointing an EU responsible person, they still offer ample opportunities for sellers to expand their audience and increase sales.

Consequently, Europe will remain one of the top destinations for ecommerce sellers in 2026 and beyond, as consumers throughout the continent continue to embrace online and cross-border shopping.

A look ahead at the future of Europe’s ecommerce

Several trends have emerged over the last few years that are likely to shape the future of the ecommerce industry in Europe.

Mobile commerce has been gaining momentum since the start of the decade. According to data released in 2023, 75% of shoppers in Spain and 72% of Italian shoppers buy products online from their online devices.

Furthermore, nearly 60% of ecommerce transactions in Europe were mobile payments, and that number could increase to 75% by 2027.

Consequently, expanding the range of payment options and optimizing product listings for mobile will become even more important for sellers on European online marketplaces.

The rise of mobile technology is far from being the only trend that has shaped Europe’s ecommerce industry since the start of the decade.

European consumers are growing more eco-conscious. The figures indicate that more than 60% of European online shoppers consider eco-friendly packaging a crucial factor in their purchasing decisions.

Hence, adopting transparency, using recyclable packaging materials, and minimizing the carbon footprint of their fulfillment process can help international sellers on European online marketplaces win consumers over.

Moreover, recent data shows that in 2025, 37% of consumers in Europe shop via live streams, fueling the rise of live shopping marketplaces like Whatnot. The live shopping trend is likely to continue growing in popularity as AR, AI, and similar new technologies become more accessible.

Identifying the growth opportunities in Europe’s emerging markets

The early projections suggest that ecommerce retail will generate €693 billion by 2029, followed by €649 billion in the UK and €616 billion in France.

Although it’s clear that these markets offer plenty of opportunities for sellers who’d like to expand their business beyond their domestic markets, establishing a lasting presence in either of them can be challenging due to high saturation.

On the other hand, the ecommerce industry is growing rapidly in Southern, Central, and Eastern Europe, with countries like Poland and Romania experiencing a rapid growth in user penetration and online purchases.

However, which emerging market is the best destination for an ecommerce brand depends on a broad spectrum of factors, ranging from the products a business offers to the online marketplace they are using and their target audience.

Although Amazon and eBay remain the most popular among European shoppers, their dominance will be challenged by smaller, local online marketplaces that cater to regional audiences.

The best-selling product categories in the European countries

The offline retail has been in decline since the start of the decade, but despite this, offline sales in Germany, France, Spain, Italy, and the UK are projected to reach €2.1 trillion by 2028.

Furthermore, the percentage of consumers who shop in brick-and-mortar stores is still considerably larger than the percentage of people who predominantly shop online.

For instance, 82% of German consumers shop offline at least once per week compared to 45% of consumers who shop online weekly.

The gap in ecommerce spending and offline spending will continue to shrink in the coming years, because the offline retail market of Europe’s five largest economies will only grow at a 1.7% CAGR until 2029.

As a result, non-essential retail has gained momentum, with purchases of products from electronics and apparel categories surging in the last few years.

Here’s a quick overview of the best-selling product categories on European online marketplaces in 2024:

- Fashion (21.6%)

- Electronics (20.8%)

- Hobbies & Leisure (20.4%)

- Furniture & Homeware (9.8%)

- Footwear (5.8%)

It’s safe to assume that products from these categories will continue to dominate sales on online marketplaces in Europe in the foreseeable future.

Therefore, businesses offering items from either of these categories have a better chance of attracting European consumers and establishing a strong presence in their target markets.

Expanding online businesses across Europe’s online markets

Despite the current geopolitical situation, mounting regulatory hurdles, and market fluctuations, the ecommerce industry in the world’s largest single market will continue to grow steadily until the end of the decade.

Besides the continent’s top five economies, countries like Estonia, Lithuania, and Austria are experiencing significant growth due to rising user penetration rates.

Moreover, online retail in Europe will continue to grow as forecasts suggest that the projected revenue of the total retail sales of the ecommerce market in Europe should exceed the €1 trillion mark by 2030.

As a result, online sellers seeking growth opportunities may benefit from expanding their operations into European countries.

Establishing a strong presence in a new market can be a challenging endeavor. Schedule a call to learn more about how Webinterpret can help eBay sellers streamline marketplace expansion.

About Webinterpret

Webinterpret supports merchants selling on eBay.

Our AI-based solutions enable more effective selling through automated listing localization, advertising, and returns and ensure all products placed on EU markets are GPSR-compliant.

By giving your international customers a full, end-to-end local shopping experience, Webinterpret improves your conversion and helps establish your business globally.